Strategic Creative for Everything, Everywhere.

Launch, refresh or activate your brand at any point in the creative process – ideation, strategy, workshops, design and build.

Bear Grylls Website Refresh

Client: Bear Grylls Ventures, U.K

Website design and build.

BeNorfolk

Client: Silverless Design U.K

Creative Direction. Brand strategy, naming and visual identity.

St.Francis School Film

Client: Silverless Design Ltd.

Video Campaign ideation, direction and post production

BKR Branding

Client: Silverless Design, U.K

Creative Director, Strategy, Brand Identity, Motion Graphics.

Podge Design Lunch 2023 X Local London

Colab: We Are Local, Mumbai

Bringing LOCAL to London. Design Podge Lunch Event at the Groucho Club, 2023. Motion, Event Graphics, Site design

Sugarway X Local

Colab: We Are Local, Mumbai

Bringing LOCAL to London in 2023. LOCAL is a cultural design studio based in India, which uses design research and creates culturally relevant and sensitive brands.

Channel 4 Racing Titles

Client: Daryl Goodrich/IMG

GFX package and title sequences.

F2 Show

Client: The Midnight Club

Event screen graphic design and animation.

Wansbrough Solicitors Brand Refresh

Client: Silverless Design, U.K

Creative Director, strategy, art direction and visual identity.

Oddizzi.com

Client: Little Travel Bug Ltd. Oddizzi.com Startup

Creative Direction. Brand Naming and Strategy. Visual Identity.

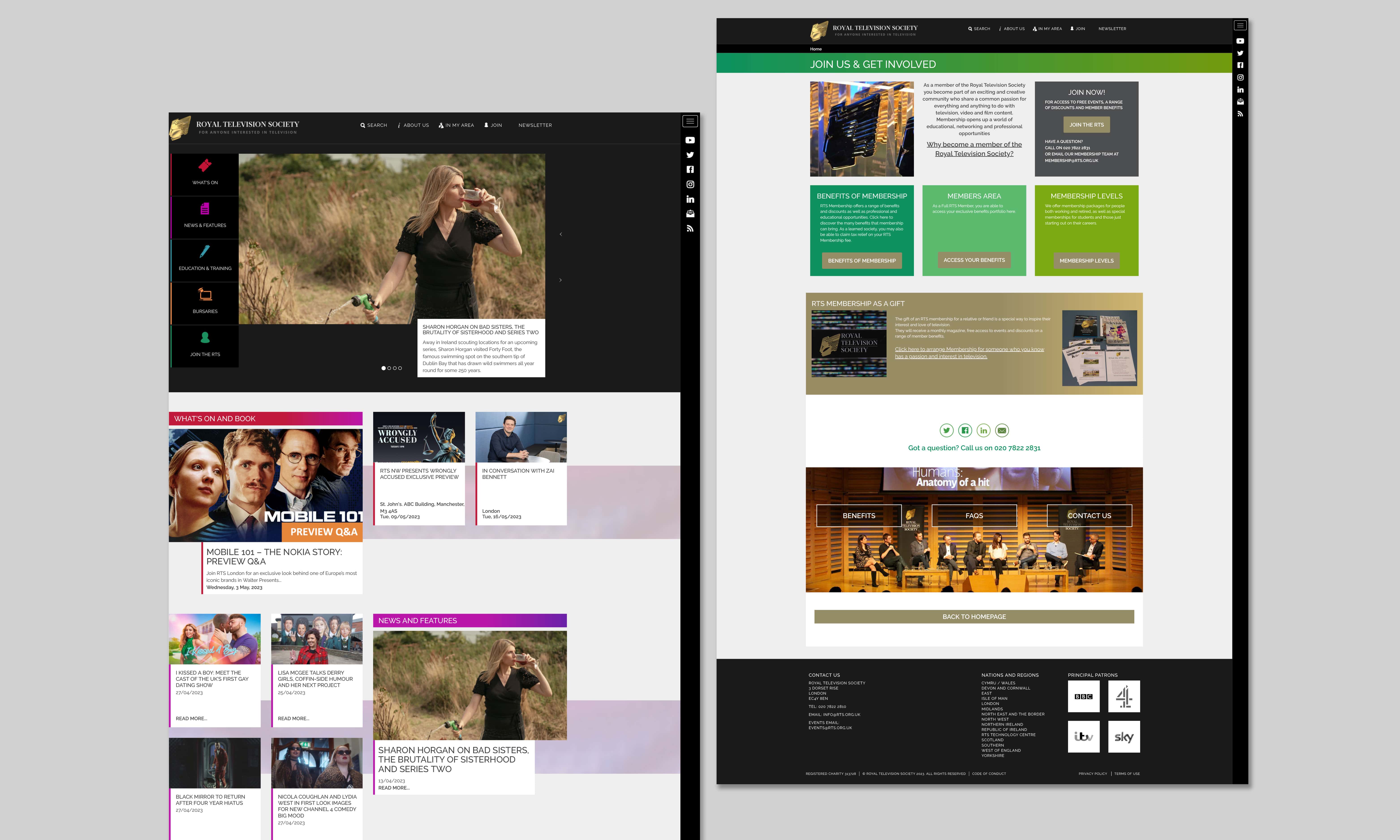

Royal Television Society Website

Client: Drupology

Website Design

Ideation and Storyboarding

I can Art Direct, produce storyboards and concept ideas for your GFX package, brand film or animation projects.

Trinity School Promo Video

Client: On Three Branding

Brand film ideation, direction, animation and production.

Zhejiang Circuit Logo Sting

Client: On Three Branding

Animation.

Channel 4 Racing Titles Pitch

Client: Daryl Goodrich /IMG

Ideation, Photography and Design.

E Games Sting

Client: On Three Branding

Animation

Northridge Law “5 years” Film Storyboard

Client: On Three Branding

Motion graphics design and animation.

Matriarch Productions

Client: Hannah & Stephen Graham

Visual identity for U.K production company

Digital design and build

Need a website ? Whatever platform, functionality or size – I can design and build it for you too with my trusted network of developers.

Water and Power Productions Branding

Client: Water and Power Productions

Visual identity, website design and build.

Royal Warrant Holders Association

Client: Drupology

Website redesign

Sky Advance Explainer

Client: Giggle Studios Bristol

Ideation, animation direction and production.

Sport 24 In Flight GFX

Client: Dunlop Goodrich

Animation

Leaders Logo Sting

Client: Brilliant Path

Animation.

IO Technologies Brand Identity

Client: IO

Creative Direction. Visual identity.Website design.

Euroleague Title Promo

Client: Daryl Goodrich /IMG

GFX Title package.

Gallery of The Giants Branding

Client: Self Initiated

Branding and Titles for @galleryofthegiants

The Clare Balding Show Titles

Client: Dunlop Goodrich / BT Studios

Live show package design, animation and production.

Tyson Fury Promo

Client: Daryl Goodrich

Design and animation.

EQ Connect Gaming Explainer Video

Client: EQ Connect

Direction, animation and production.

Northridge Law “Year One” Explainer Film

Client: On Three Branding

Art direction, animation and production.

McLaren Brand Launch

Client: Daryl Goodrich

Art direction, design, animation and production.

HSBC VIP Lounge Film

Client: Daryl Goodrich / North One

Art Direction, Ideation, Animation and Production.

Chelsea Football Club Promo

Client: Daryl Goodrich

Design and animation.

Raw Net Logo Sting

Client: Brilliant Path

Animation

Ruby Hammer Website

Client: Ruby Hammer

Visual Identity, website.

PG Online Brand Film

Client: On Three Branding

Direction, animation and production.

HSBC VIP Lounge Film

Client: Daryl Goodrich /North One

Large format screen graphic package.

Total Combat Show GFX Package

Client: Dunlop Goodrich /BT studios

Titles and live show GFX design and animation.

Motion Graphics and Film

Need to make your brand move ? – I can design, produce, direct and deliver video, motion and GFX for any production and any type of screen with my trusted network of animators and film buddies.

Incycle TV Sting

Client: Dunlop Goodrich

Logo design, GFX Show package design and animation.

FEI “Time to Beat” Title Sequence

Client: Daryl Goodrich

Production services.

Saudi Racing Titles

Client: Daryl Goodrich

Art direction, production services.

School of Booze Social Animations

Client: School of Booze

Brand Ambassador. Creative Direction. Visual Identity, Animation.

SB Tech Screen Content

Client: Enigma Creative

Event screen graphics design, production and animation.